The Dragon's appetite is growing:

Are Canadian SMEs ready?

China is moving from an export-led growth model towards a more domestically-oriented economy. Going forward, consumer demand is expected to increasingly support China’s growth. This change has many implications for the global economy. In particular it offers interesting opportunities for Canadian exporters looking for new markets.

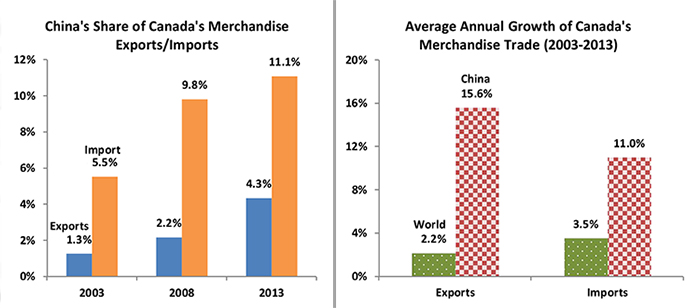

China, Canada’s second-largest trading partner after the U.S., imported $20.5 billion worth of Canadian goods in 2013. This was up 5.8 percent from their 2012 level of $19.4 billion. Over the last decade, Canada’s merchandise exports to China have enjoyed an annual growth rate of over 15 percent. A large share of this growth has come from Canadian exports of forestry products and agricultural goods, each alone accounting for about a quarter of China’s imports from Canada. Both of these product categories are likely to benefit from increased consumer demand, with agricultural goods being buoyed by rising income. Urban development and a growing middle class are both key contributing factors to China’s consumer driven growth. With economic rebalancing being one of China’s primary goals today, the government is likely to support intensifying consumer demand for many years to come.

The growing importance of consumer demand in the Chinese economy presents vast opportunities to Canadian companies, especially for small and medium-sized enterprises (SMEs). According to the most recently available data (2011), 9.5 percent of Canadian SME exporters export to China. The same survey identifies that 16.7 percent of Canadian SMEs exporting to China are exporting goods from the agriculture, mining and oil and gas extraction industrial sector. A further 14.9 percent are involved in wholesale trade and 10.1 percent in transportation and warehousing. But with only 10.4 percent of Canadian SMEs exporting, and only 9.3 percent of those to China, there is a great number of Canadian SMEs potentially missing out on the Chinese market.

Despite China’s slowing growth pattern from double digits to the self-determined goal of around 7.5 percent, its demand for imports is unlikely to slow in the foreseeable future. Indeed, by pushing for heightened consumer demand, China’s appetite for imports should only grow.

The Upshot

Looking forward, Canada’s trade relationship with China will continue to evolve. As China’s GDP growth slows and it strives to achieve the economic balancing goals set out in its most recent five-year plan, it is likely that the types of goods and services Canada trade with China will become more reliant on support from consumer demand. For Canadian SMEs already engaged in the Chinese markets across a number of industrial sectors this represents an untapped potential.

For more information, visit Foreign Affairs, Trade and Development Canada’s Office of the Chief Economist.

Subscribe to: CanadExport