Climate finance opportunities with the Inter-American Development Bank

The Canadian Trade Commissioner Service has more than 160 offices around the world with dedicated officers available to assist you with international trade activities. Specialized assistance is available for climate finance.

For information on the IDB, contact Faheem.NoorAli@international.gc.ca

Inter-American Development Bank Group (Washington D.C.)

The Inter-American Development Bank (IDB) is the oldest and largest regional development bank, and the main source of development financing, in Latin America and the Caribbean. The IDB’s mission is to reduce poverty and inequality, and promote sustainable economic growth, with a strategic focus of addressing the needs of small and vulnerable countries, and fostering development through the private sector. Its updated institutional strategy for 2019–2023 outlines three strategic objectives to promote (i) social inclusion and equality; (ii) productivity and innovation; and (iii) regional integration, where gender equality and diversity, climate change and sustainability, and institutional capacity and the rule of law are cross-cutting priorities.

Established in 1959, the IDB currently has 48 member countries, including 26 borrowing member countries (BMCs) and 22 non-borrowing member countries. In 2017, the IDB approved 90 sovereign-guaranteed operations to BMCs for US$11.4 billion. As described further below, in addition to the IDB, the IDB Group’s private sector and non-sovereign operations Footnote 1 are conducted through IDB Invest and the Multilateral Investment Fund.

Among non-borrower member countries, Canada is IDB’s third largest non-borrowing shareholder (note that Canada is sixth overall).

Text version

| 2017 IDB Commitments by Sector Grouping (US$ millions) |

|

|

|

|

Procurement processes

The IDB’s procurement policies cover project-related procurement by BMCs, operational-related work executed by the IDB, as well as IDB corporate procurement. The IDB’s sovereign operations through BMCs involve procurement of goods, works and services provided by firms and individuals governed by the IDB’s Policies for the Procurement of Goods and Works Financed by the Inter-American Development Bank and the Policies for the Selection and Contracting of Consultants Financed by the Inter-American Development Bank. Procurement notices related to BMC procurements are available online. The IDB also procures services related to operational work (e.g. knowledge products, advisory), which is governed by the Policy for the Selection and Contracting Firms for Bank-Executed Operational Work; bank-executed operations (BEO) opportunities are available on-line at BEO Procurement Opportunities. The IDB’s internal procurement needs, governed by the Corporate Procurement Policy, are available online at Corporate Procurement Opportunities. In all cases, only companies and professionals domiciled in, or nationals of, one of the IDB’s member countries are eligible to supply goods and services financed with IDB resources. Similarly, only goods that originate in IDB member countries may be procured with IDB resources. It is important to note that procurement pertaining to private sector and non-sovereign operations through IDB Invest shall be carried out by project proponents on the basis of acceptable private sector or commercial practices; furthermore, such procurement includes a requirement that negotiations be conducted on an arm’s length basis.

Procurement by developing member countries

Goods, works, non-consulting and consulting services: In most cases, the IDB recommends international competitive bidding (ICB) as the most appropriate method for public procurement. In certain circumstances, other procurement methods (e.g. limited international bidding, national competitive bidding, direct contracting, and force accounts) may be used. As part of the procurement process, BMCs must prepare a general procurement plan in conjunction with the IDB. While the IDB encourages the use of country systems, should BMC procurement systems be deemed inadequate, the IDB’s procurement systems may be used.

Procurement by the IDB

Corporate procurement: All IDB contracts are awarded through small purchase (procurement card); competitive bidding; competitive proposals; cooperative purchasing; non-routine procurement (e.g. non-competitive, emergency or special procurement); or reverse auction. In addition, the IDB may pre-qualify suppliers for a specific procurement via a pre-qualification inquiry (PQI) and invitation to identified potential suppliers. Potential suppliers can register through the Supplier Registration Form.

Bank-executed operational work:

Firms interested in participating in BEO procurement selection processes must submit expressions of interest using the BEO bidder portal.

Private sector operations

In addition to the IDB, the IDB Group includes IDB Invest and the Multilateral Investment Fund (MIF). The MIF, which is administered by the IDB, is an innovation laboratory that aims to promote development through the private sector by identifying, supporting, testing and piloting new solutions to development challenges and seeking to create opportunities for the poor and vulnerable populations in the region.

Established in 1991, the MIF currently has 39 donor countries, including Canada, and is the region’s largest provider of technical assistance for private sector development. Focusing on climate-smart agriculture, inclusive cities and the knowledge economy, the MIF approved 67 projects in 2017 for a total of US$85 million: US$47 million in technical cooperation operations and US$38 million in small loans and equity investments, primarily in funds.

In January 2016, the IDB Group’s private sector operations (except for the MIF) were consolidated in IDB Invest (the commercial brand of the Inter-American Investment Corporation [IIC] since November 2017). The IIC was established in 1985 and currently has 45 member countries, including Canada. The mission of IDB Invest is to promote the economic development of Latin America and the Caribbean through the private sector. IDB Invest supports the private sector and state-owned enterprises through loans, equity investments, guarantees, advisory services and technical assistance. In 2017, IDB Invest approved 234 projects, with a financing volume of US$3.2 billion.

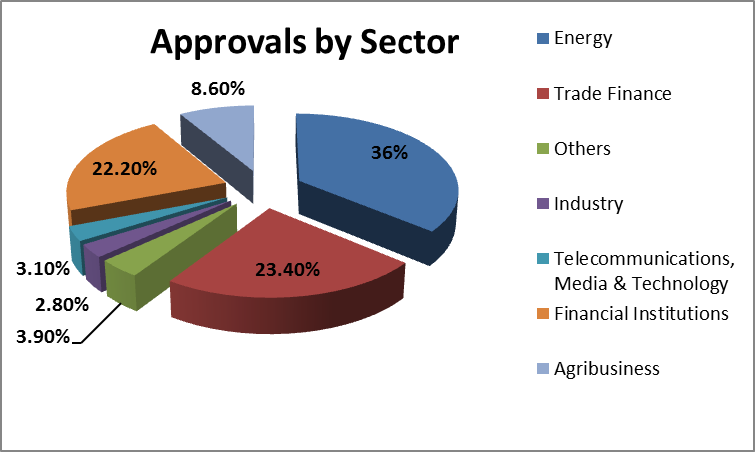

Text version

| Energy 36% |

| Trade Finance 23.4% |

| Industry 2.8% |

| Telecommunications, Media & Technology 3.1% |

| Agribusiness 8.6% |

| Others 3.9% |

| Financial Institutions 22.2% |

Private sector finance: Private companies and state-owned enterprises may obtain financing from IDB Invest in a wide variety of sectors, including infrastructure (energy, transportation, water and sanitation, and social infrastructure), financial entities (investment funds, banks, microfinance institutions, factoring and leasing companies), as well as agribusiness, manufacturing, tourism, telecommunications, and media and technology. IDB Invest provides a suite of financial products, including:

Loans

- Senior and subordinated debt

- Foreign and local currencies

- Syndicated loans

Technical assistance/grants

- Capacity building, advisory services, feasibility studies

Equity and quasi-equity

- Direct investments into companies and private equity funds

Guarantees

- Partial credit enhancements and risk-sharing guarantees

While there is no standard method of applying for IDB Invest financing, applicants should be prepared to provide:

(i) a description of the enterprise/project; (ii) sponsor/shareholder information, including track record and financial wherewithal; (iii) initial financing plan, including type and amount of financing desired, and uses of funding; (iv) a preliminary business plan demonstrating commercial viability; (v) implementation arrangements and operations; (vi) market information; (vii) relevant risk analyses and mitigation efforts; and (viii) a preliminary review of environmental, social and economic impacts.

Climate finance

IDB Group has committed to increasing the volume of climate-related financing to 30% of its operational approvals by 2020 as part of the IDB Climate Change Action Plan 2016–2020. In 2017, IDB Invest already classified 36% of its projects as climate friendly. In addition to directing its own capital toward climate-related investments, the IDB Group acts as an intermediary for the Green Climate Fund, the Global Environment Facility and the Climate Investment Funds as these funds generally do not accept direct applications from the private sector. Moreover, the IIC manages the Canadian Climate Fund for the Private Sector in the Americas along with other climate-relevant donor trust funds. While financial products that IDB Invest provides from its own capital are subject to market-based terms and conditions, financial products offered through intermediated and donor funds may be offered at concessional (or sub-market) terms and conditions, at just a level of concessionality needed to facilitate the investment; thus, funding recipients are provided with a blended financing solution.

Accessing private sector and climate finance

Canadian companies can access private sector financing and climate finance for projects for which they are a sponsor through IDB Invest: financing@iic.org